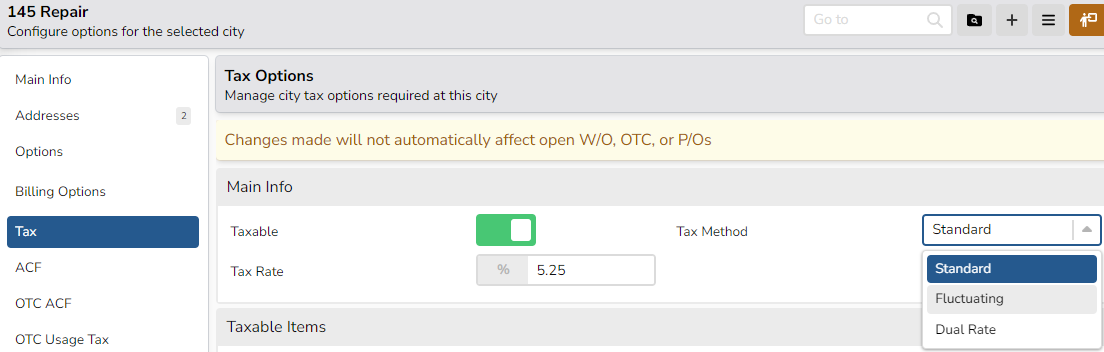

Tax Rate Options

EBIS 5 supports 3 taxing methods on the City Level: Standard, Dual Rate, & Fluctuating

Configuring Tax Options from Config > City > (select city)

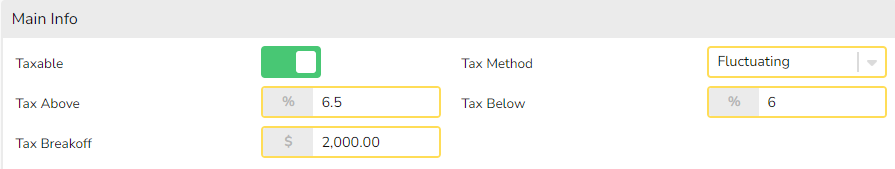

The Tax setup screen is available from the sidebar and is used to configure the city tax rate and what items are to be taxed.

Be sure that the "Taxable" toggle is enabled (green), then select the Tax Method from the drop down, and enter the desired Tax Rate

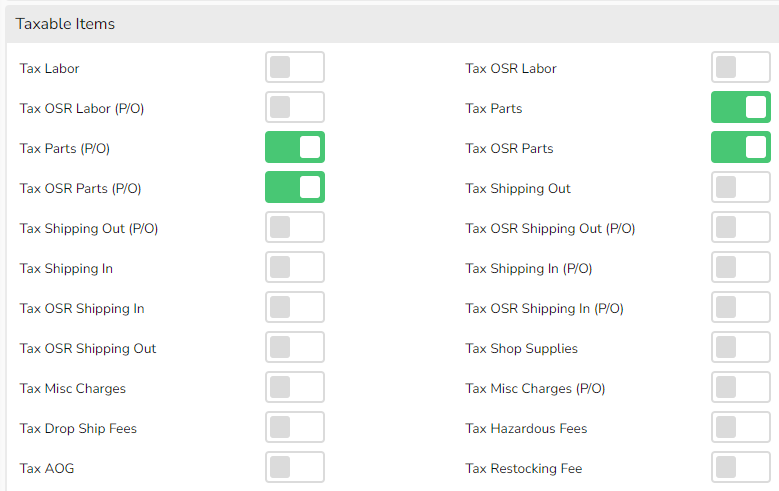

Next, scroll down & enable all taxable items:

EBIS 5 supports three taxing methods:

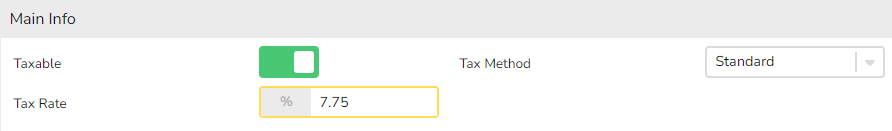

(1) Standard: Uses a standard tax % rate

Example: Tax Rate: 7.75%

Total amount taxable: $2,500.00

Tax: $2,500.00 * 7.75% = $193.75

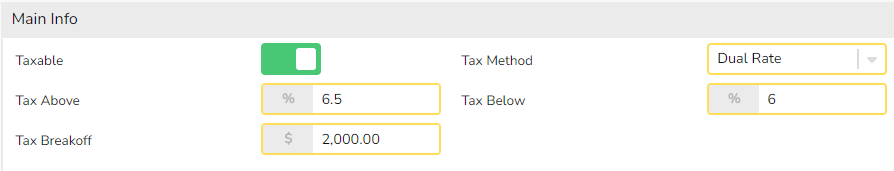

(2) Dual Rate: Charges two different tax rates using a determined break-off amount.

Example: Break-off amount: $2,000.

Rate <= to: 6.50% (this is the rate less than or equal to break-off)

Rate Above: 6.00% (this is the rate above the break-off)

Total taxable amount in sample work order: $2,500.00

Tax: ($2,000 * 6.25%) + (500 * 6.00%) = 125 + 30 = $155.00

(3) Fluctuating: Charges one percentage, depending on the amount.

Example: Break-off amount: $2,000.

Rate <= to: 6.50% (this is the rate less than or equal to break-off)

Rate Above: 6.00% (this is the rate above the break-off)

Total taxable amount in sample work order: $2,500.00

Tax: ($2,500 * 6.00%) = $150.00